| Insurance IP

Bulletin

An Information Bulletin on

Intellectual Property activities in the insurance

industry

A Publication of - Tom Bakos Consulting, Inc. and Markets, Patents and Alliances, LLC |

February 2009 VOL: 2009.1 |

||

| Adobe pdf version | Give us FEEDBACK | ADD ME to e-mail Distribution |

| Printer Friendly version | Ask a QUESTION | REMOVE ME from e-mail Distribution |

| Publisher Contacts

Tom Bakos Consulting, Inc.

Tom Bakos: (970) 626-3049 tbakos@BakosEnterprises.com Markets, Patents and Alliances, LLC Mark Nowotarski: (203) 975-7678 MNowotarski@MarketsandPatents.com Patent WatchMore Variable Annuity IP Dealing with Guaranteed

Payouts A series of patent

applications assigned to Hartford Fire Insurance

Company were published on January 29, 2009 – filed in

November/December 2007. These

five applications (Pub. Nos. 2009/0030735 – 0030739) all appear to provide

alternative methods for withdrawing cash from a variable annuity during

the accumulation phase, that is, without annuitizing. The description below (taken from the

Specification Summary of the Invention for 2009/0030735) generally

summarizes the concept being applied (underlining added): [0014]The present

invention provides a data processing method for administering a deferred

variable annuity contract during the accumulation phase wherein

the annuity contract has a guarantee of lifetime benefit payments …

Patent Q & A Royalties?Question: What is a “reasonable royalty”? Disclaimer:The answer below is a discussion of typical practices and is not to be construed as legal advice of any kind. Readers are encouraged to consult with qualified counsel to answer their personal legal questions. Answer: A reasonable royalty is whatever the market says it is. Details: When a US patent is infringed, the

patent owner is entitled to at least a “reasonable royalty” as

compensation for the infringement (35 USC

284). What exactly “reasonable” means is

determined by a court with the help of expert witnesses. As you can imagine, this can be a

difficult (read “expensive”) determination since it varies by industry,

technology and the specific circumstances of a given case. It’s particularly challenging in financial services since, unlike

the pharmaceuticals, electronics or chemicals industries, there are very

few examples to go on. In the Lincoln case posted below, a

jury found that 10 b.p. of the assets under management (AOM) was a

reasonable royalty for a process for administering variable annuities with

guaranteed minimum withdrawal benefits. Do you agree? For those that want to comment,

we’ve created an instant poll.

(What fun!) Follow-up Q&AIn the December 2008 issue of the IIPB our Q&A asked the question “Are patents Art?” and Crystal Megaridis responded “absolutely” with respect to the first patent her great, great grandfather, Nicolas Clute, filed in 1857 - # 17,555, “Harvester”. At the time we did not have

a picture to illustrate this work of art. We now do. See it here. Lincoln National Life Insurance Company Alleges Patent Infringement - GMWB Lincoln National Life Insurance Company has three patents (US 6,611,815; US 7,089,201; and US 7,376,608) covering the methods and processes used in providing Guaranteed Minimum Withdrawal Benefits (GMWBs) for variable annuities. Two additional published patent applications are pending. Lincoln is asserting its patent rights (see story above) through patent infringement lawsuits against competitors who offer GMWBs. An ex parte re-examination request has been granted by the USPTO with respect to US 7,089,201.

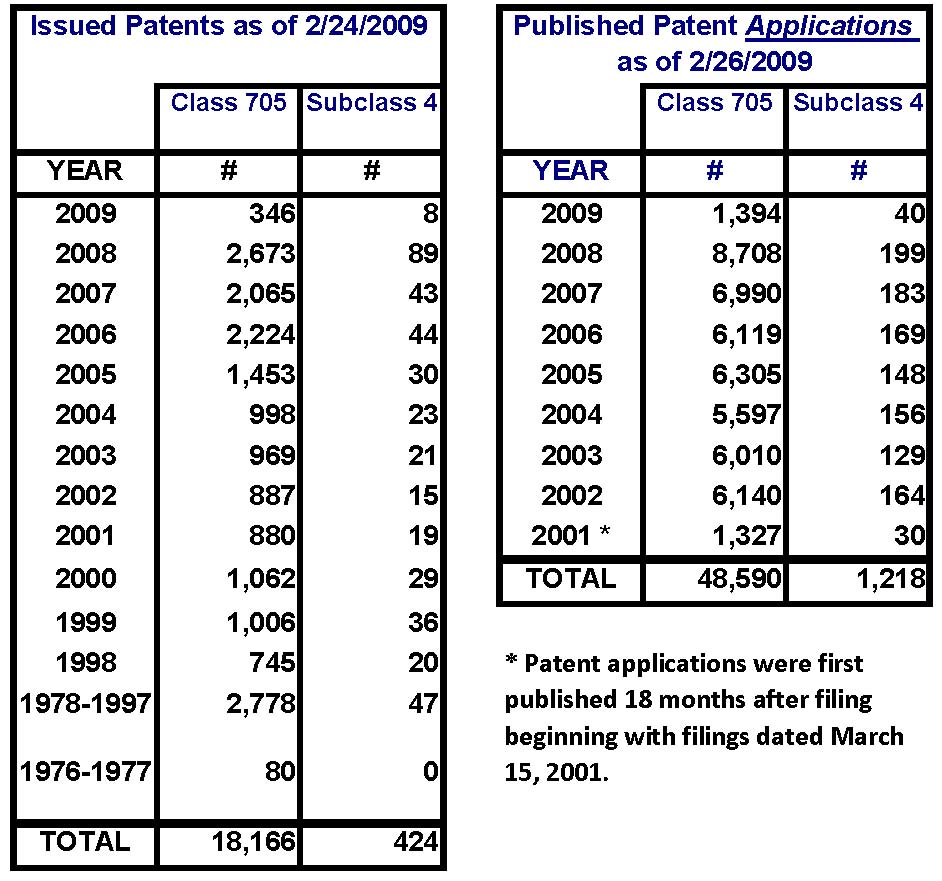

Statistics An Update on Current Patent Activity The table

below provides the latest statistics in overall class 705 and subclass 4.

The data shows issued patents and published patent applications for this

class and subclass.

Class 705 is defined as: DATA PROCESSING: FINANCIAL, BUSINESS PRACTICE, MANAGEMENT, OR COST/PRICE DETERMINATION. Subclass 4 is used to identify claims in class 705 which are related to: Insurance (e.g., computer implemented system or method for writing insurance policy, processing insurance claim, etc.). Issued

Patents In class 705/4, 12 new patents have been issued since 12/16/2008 – 4 to close out 2008 and 8 in the first two months of 2009. Patents are issued on Tuesdays each week. Patents are categorized based on their claims. Some of these newly issued patents, therefore, may have only a slight link to insurance based on only one or a small number of the claims therein. The Resources section provides a link to a detailed list of these newly issued patents.Published Patent

Applications In class 705/4, 43 new

patent applications have been published since 12/18/08 – 3 to close out

2008 and 40 in the first two months of 2009. Patent applications are published

on Thursdays. Again, a reminder - Patent applications have been published 18

months after their filing date only since March 15, 2001. Therefore, there are many pending

applications that are not yet published. A conservative estimate would be that

there are, currently, close to 250 new patent applications filed every

18 months in class 705/4. The published patent applications included in the table above are not reduced when applications are issued as patents, rejected, or abandoned. Therefore, the table only gives an indication of the number of patent applications currently pending. Resources Recently published issued U.S. Patents and U.S. Patent Applications with claims in class 705/4. The following are links to web sites which contain information helpful to understanding intellectual property. United States Patent and Trademark Office (USPTO) : Homepage - http://www.uspto.gov/ United States Patent and Trademark Office (USPTO) : Patent Application Information Retrieval - http://portal.uspto.gov/external/portal/pair Free Patents Online - http://www.freepatentsonline.com/

Patent Law and Regulation - http://www.uspto.gov/web/patents/legis.htm Here is how to call the USPTO Inventors Assistance Center:

Mark Nowotarski - Patent Agent services – http://www.marketsandpatents.com/ Tom Bakos, FSA, MAAA - Actuarial services – http://www.BakosEnterprises.com |

Introduction

In this issue’s feature article, Reacting to Interest in Your IP, we give our readers some general advice on how to handle unsolicited interest in their IP. We hope that you, if you are ever in this position, will find this advice useful.

In addition, check out the Updates and Patent Watch on GMWB IP – Lincoln National has won an infringement lawsuit and Hartford Fire has filed some more.

Our

mission is to provide our readers with useful information on how

intellectual property in the insurance industry can be and is being

protected – primarily through the use of patents. We will

provide a forum in which insurance IP leaders can share the challenges

they have faced and the solutions they have developed for incorporating

patents into their corporate culture.

Thanks, Tom

Bakos & Mark Nowotarski FEATURE ARTICLE Reacting

to Interest in Your IP

Co-Editors, Insurance IP Bulletin You may have filed a patent application for a lot of reasons. Principal among those reasons, of course, is to protect your intellectual property. If you are an independent inventor you will have a personal interest in the successful implementation of your IP. By creating a patent application or getting an issued patent you also advertise your IP and may attract interest in it. So, what if someone calls? Here are some tips based on our own experience: · Be prepared · Listen more than you talk · Do your homework · Get help Be Prepared Once your patent

application is published or once your patent actually issues, it is out

there for anyone to see – interested people or organizations may either

stumble upon it or may be actively looking for it. When they call, you should be

prepared with a fairly clear idea of what your goals for it are. Clear but flexible goals are a tremendous source of negotiating

strength.

Some

possibilities …

If you

are interested in or expect to need help in development and marketing your

invention, than be prepared to address how others might be

involved.

· Maybe you are looking for many partners and, therefore, interested only in non-exclusive licensing opportunities? · You may anticipate that your personal involvement would be necessary to get the most success from your invention. For example, you have some specialized knowledge or the research you have already done on implementation adds value. So, maybe you will need to emphasize that your continued personal involvement is something you desire and think necessary. · Maybe you’ve moved on to bigger and better things and have no real interest in pursuing the commercialization of the invention. Then an outright sale may be what you are looking for. You should also be prepared

with a clear idea of what information about your invention’s status you

are willing to share in an initial conversation with someone you may have

never met. The key is to know

what information your caller is going to need in order for both of you to

take the next step and what information is best left for later when you

have a secrecy agreement in place. Which

brings us to the next point: Listen more than you talk Most inventors love to talk

about their inventions. This

can be especially true when they receive an unsolicited call from someone

else expressing interest and even a willingness to pay for rights for the

invention. It is far more

important to your ultimate success, however, to listen and ask the caller

probing questions in order to determine the basis for the caller’s

interest in your invention and what in it is of value to them. This will help later when talking royalties or price.

If the first call goes well and a follow up call is planned, then it is time to “hit the books”. As Gary Karrass explained in his influential book “Negotiate to Close”, your goal is to “build a profitable deal that sticks”. In order to do that, you need to know as much as possible about the interested party and what value your invention will bring to them. You need to know what their agenda is as well as you know your own. You can then structure the deal that will be profitable for both. You need to have answers to the questions:

All of these questions can be addressed through diligent research and consultation with experts in the field. Which brings us to our last point:

Inventors tend to be innovative, do-it-yourselfers. But don’t try to re-invent the wheel! Unless you are a seasoned negotiator your chances of success are greatly diminished if you try to go it alone. An inventor’s great strength in inventing is their personal commitment to the invention. “Personal commitment”, however, can be a significant liability in negotiation. In business negotiation you always have to remember that “it’s nothing personal, just business”. This is where a negotiator / broker/ consultant can be so valuable. It may be your first patent negotiation, but it’s not theirs. They know how the game is played.

Update Lincoln

National Wins Jury Verdict in Patent Infringement

Lawsuit

Essentially, the claims identify intellectual property related to the administration of variable annuity benefits that provide what are commonly known as Guaranteed Minimum Withdrawal Benefits (GMWBs). Claim 35 is the independent claim which describes an administrative process for continuing to make guaranteed minimum payments from a variable annuity account even if the account value is exhausted before all payments are made.

· v. Transamerica et. al. for infringing Lincoln’s patent US 7,376,608 (issued 5/20/2008) – a patent with claims focused on the GMWB feature.

· v. Jackson National Life Insurance Company for infringing Lincoln’s patents US 6,611,815 (issued August 26, 2003) and US 7,089,201 – both of which contain claims focused on GMWB features. · v. Sun Life Insurance Company of Canada (& New York) for infringing all three Lincoln patents addressing GMWB features – US 6,611,815; US 7,089,201; and US 7,376,608.

Also of interest is the fact that an ex parte reexamination of US 7,089,201 has been granted by the USPTO and is currently in process. As of our date of publication, no office action has been issued.

If the USPTO on reexam should find Lincoln’s claims in US 7,089,201 invalid in light of the prior art, then, of course insurance companies that issue variable annuities with GMWB benefits would have less to worry about. But, remember that Lincoln still has two other issued patents covering very similar IP and, as noted above, their most recent lawsuits claim infringement of all three.

|