|

Insurance IP Bulletin

An Information Bulletin on Intellectual Property activities in the insurance industry

A Publication of - Tom Bakos Consulting, Inc. and Markets, Patents and Alliances, LLC |

October 2010 VOL: 2010.5 | ||

| Adobe pdf version | Give us FEEDBACK | ADD ME to e-mail Distribution |

| Ask a QUESTION | REMOVE ME from e-mail Distribution |

|

Publisher Contacts

Tom Bakos Consulting, Inc.

Tom Bakos: (970) 626-3049 tbakos@BakosEnterprises.com Markets, Patents and Alliances, LLC Mark Nowotarski: (203) 975-7678 MNowotarski@MarketsandPatents.com Patent Q & A Declaratory Judgment Question: What is a “declaratory judgment” and how does it protect my freedom to offer an insurance product in the market that might violate someone else’s issued patent? Disclaimer: The answer below is a discussion of typical practices and is not to be construed as legal advice of any kind. Readers are encouraged to consult with qualified counsel to answer their personal legal questions.

Answer: An individual or a company with a product it fears may at some point in the future be alleged to violate another’s patent may find the uncertainty in that situation relieved through a declaratory judgment. Rather than wait (perhaps years) for a lawsuit alleging infringement to be filed, the individual or company can instead force the issue and seek a court ruling (i.e., a declaratory judgment) through which a US District Court declares the rights, duties, and obligations of the parties involved. Typically, in a potential patent infringement case the remedies sought through a declaratory judgment are either that there is no infringement or that the patent or patents involved are invalid and, therefore, unenforceable.

Another company, Hughes Telematics, Inc. (HTI), also provides electronic systems for cars – so called telematic systems – which link the driver, car, and external data services through cellular web portals to enhance safety, security, convenience, and provide maintenance and information services. HTI has a number of patents which it has alleged through HTI IP, LLC that Xirgo Technologies and others have infringed.

Instead of waiting for the ax to fall, Progressive filed a Complaint for Declaratory Judgment. In this complaint Progressive asks the court to declare the three patents owned by HTI LP, LLC which affect Progressive’s business to be invalid. Thus, a declaratory judgment does not specify that any particular action be taken. It is merely a legally binding opinion expressed by the judge of an appropriate court with jurisdiction. Whatever the outcome (Progressive presumably hopes the judge would rule the HTI IP, LLC patents to be invalid), the uncertainty of the situation would be removed. Statistics An Update on Current Patent Activity

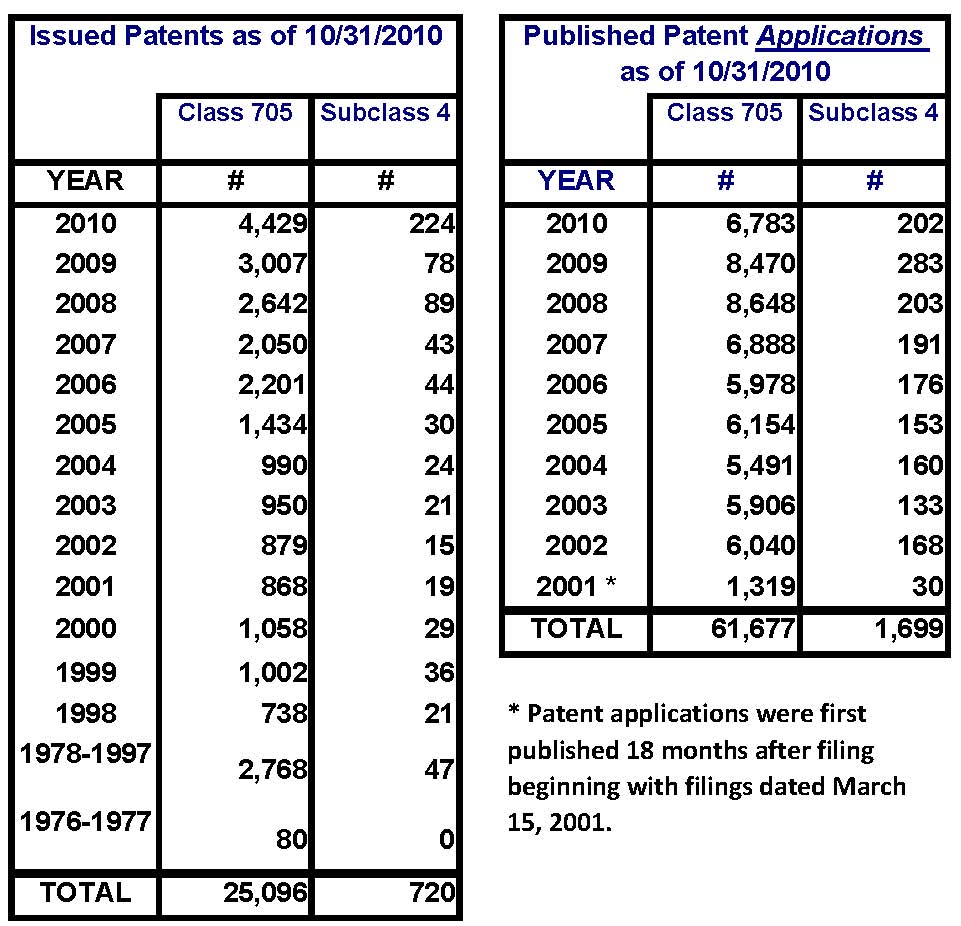

The table below provides the latest statistics in overall class 705 and subclass 4. The data shows issued patents and published patent applications for this class and subclass.

Class 705 is defined as: DATA PROCESSING: FINANCIAL, BUSINESS PRACTICE, MANAGEMENT, OR COST/PRICE DETERMINATION.

Subclass 4 is used to identify claims in class 705 which are related to: Insurance (e.g., computer implemented system or method for writing insurance policy, processing insurance claim, etc.).

Patents are categorized based on their claims. Some of these newly issued patents, therefore, may have only a slight link to insurance based on only one or a small number of the claims therein. The Resources section provides a link to a detailed list of these newly issued patents.

Published Patent Applications

The Resources section provides a link to a detailed list of these newly published patent applications.

The following are links to web sites which contain information helpful to understanding intellectual property. United States Patent and Trademark Office (USPTO) : Homepage - http://www.uspto.gov/ United States Patent and Trademark Office (USPTO) : Patent Application Information Retrieval - http://portal.uspto.gov/external/portal/pair Free Patents Online -http://www.freepatentsonline.com/ US Patent Search - http://www.us-patent-search.com/ World Intellectual Property Organization (WIPO) - http://www.wipo.org/pct/enPatent Law and Regulation - http://www.uspto.gov/web/patents/legis.htm Here is how to call the USPTO Inventors Assistance Center:

The following links will take you to the authors' websites. Mark Nowotarski - Patent Agent services - http://www.marketsandpatents.com/ Tom Bakos, FSA, MAAA - Actuarial services- http://www.BakosEnterprises.com |

Introduction

In this issue's feature article, Speculation, Breakthroughs, and Abandonment , Mark Nowotarski looks at statistical information drawn from the Patent Information and Retrieval System (PAIR) in order to classify patents and as a way to estimate potential commercial value. In our Patent Q/A , Declaratory Judgments , we look at how you can file a lawsuit in Federal Court to have a patent declared invalid. Progressive Casualty Insurance just initiated one of these lawsuits to invalidate several patents that were seen as a threat to its MyRate™ Usage Based Car Insurance plans. The Statistics section updates the current status of issued US patents and published patent applications in the insurance class (i.e. 705/004). We also provide a link to the Insurance IP Supplement with more detailed information on recently published patent applications and issued patents.

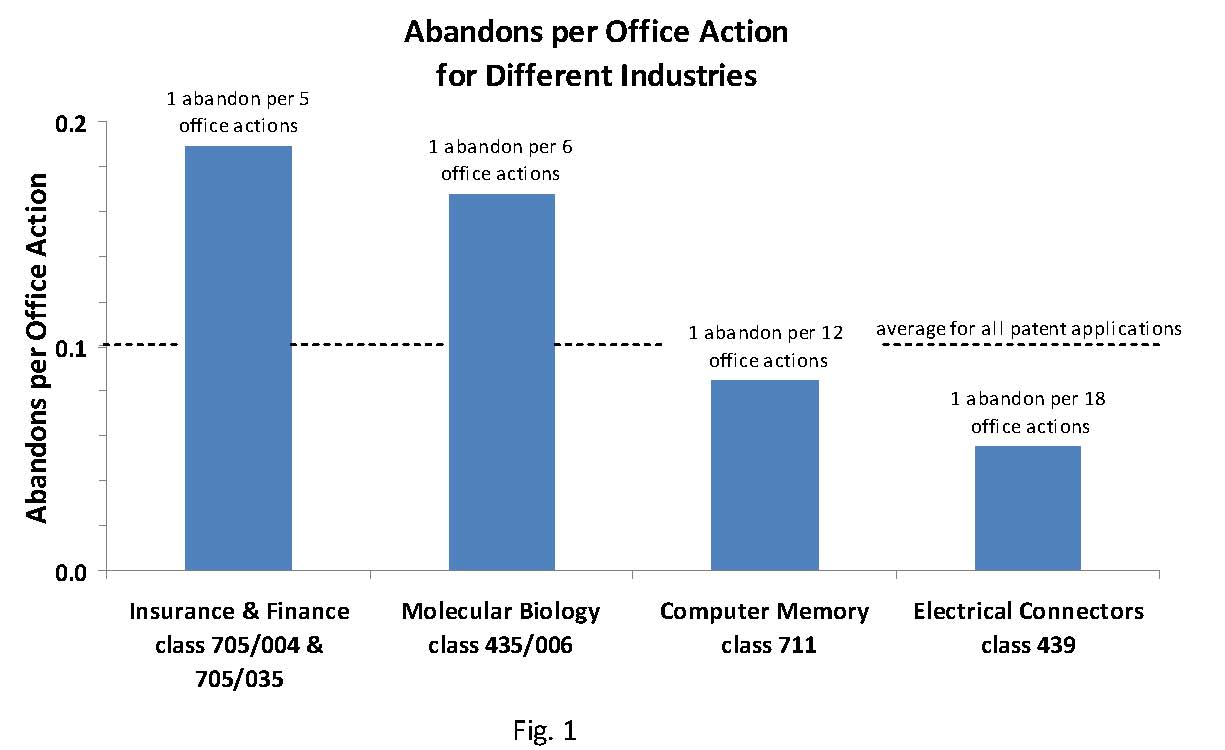

Our mission is to provide our readers with useful information on how intellectual property in the insurance industry can be and is being protected - primarily through the use of patents. We will provide a forum in which insurance IP leaders can share the challenges they have faced and the solutions they have developed for incorporating patents into their corporate culture. Please use the FEEDBACK link to provide us with your comments or suggestions. Use QUESTIONS for any inquiries. To be added to the Insurance IP Bulletin e-mail distribution list, click on ADD ME. To be removed from our distribution list, click on REMOVE ME. Thanks, Tom Bakos & Mark NowotarskiFEATURE ARTICLE Speculation, Breakthroughs, and Abandonment By: Mark Nowotarski - Co-editor, Insurance IP Bulletin Everyone thinks they have a great idea when they file a patent application. Some applications, however, are more speculative that others. We propose that the rate at which patent applications are abandoned is a reliable measure of just how speculative a given portfolio of applications is. We also propose that breakthrough inventions are more likely to be found in highly speculative portfolios, such as groups of insurance and finance patent applications, than in less speculative portfolios with lower abandonment rates. We support these propositions with data from the patent office’s PAIR data set. The abandon rate of a portfolio of applications can be quantified by “abandons per office action”. Abandons per office action is the ratio of the total number of abandons to total number of office actions in a given portfolio. “Abandons” means failure of an applicant to respond to an office action in the statutory time period allowed for response. It also includes express abandonments made at the applicant’s own initiative. “Office actions” includes all correspondence from the patent office to the applicant that has a deadline for response. Office actions with response deadlines include restriction requirements, rejections of claims and notices of allowance. The data on abandons and office actions for a given portfolio of applications can be found in the USPTO’s Patent Application Information Retrieval system (PAIR). Data for each individual application in a portfolio is retrieved by entering the application’s serial number or publication number. The status of an application (e.g. patented, abandoned, etc.) is found on the “Application Data” tab. A listing of the office actions is found on the “Transaction History” tab. The office actions can then be counted. Office actions for still pending applications and issued patents are counted since each of these office actions could have lead to an abandonment. The average abandons per office action for US utility patent applications is 0.1. This means that one application is abandoned for every 10 office actions in an average portfolio. We examined a random sample of 400 applications filed over the past ten years to determine this ratio. Abandons per office action has remained fairly constant over this time period. Abandons per office action can be interpreted as a level of speculation in applications. Applications that have high abandon rates are highly speculative. Most of the inventions described in these applications ultimately have little commercial value and the applications are abandoned quickly. If a portfolio of speculative applications as a whole, however, has commercial value, then that value is concentrated in a few “breakthrough” applications. For some investors, this is a very desirable characteristic and they may wish to seek out portfolios with high abandon ratios. Applications with low abandons per action cover inventions that are more incremental in nature. Their future commercial value is more predictable and stable. As time goes on, fewer drop out. If the portfolio as a whole has value, then the value is more evenly distributed among the individual applications and there are fewer breakthroughs. An even distribution of value can be a very desirable characteristic for other investors who are looking for more stable “returns on innovation”. Investors of this sort may wish to seek out portfolios with low abandon ratios.

Figure 1 shows how average abandons per actions vary for different industries. Insurance & Finance and Molecular Biology applications are abandoned at a relatively high rate. These are very speculative areas where most inventions don’t pan out, but the ones that do can be extremely valuable. Pharmaceutical companies, for example, file thousands of applications on initially promising compounds and then rigorously weed those out to a remaining handful that cover compounds that become approved drugs. Each one of these remaining compounds can be a billion dollar invention, but it takes an initially large portfolio of very speculative compounds to capture them. Insurance and finance inventions are also highly speculative. Most of these inventions fail, but some have gone on to impact entire economies. Witness the dot com revolution of the 1990s which was largely driven by patented financial business method inventions such as eBay, Priceline, and Amazon. Computer memory and electrical connector inventions have lower than average abandons per action. Inventions in these fields over the past decade have tended to be incremental. It’s been a while, for example, since anyone has invented anything in these fields as fundamental as the transistor or microprocessor.

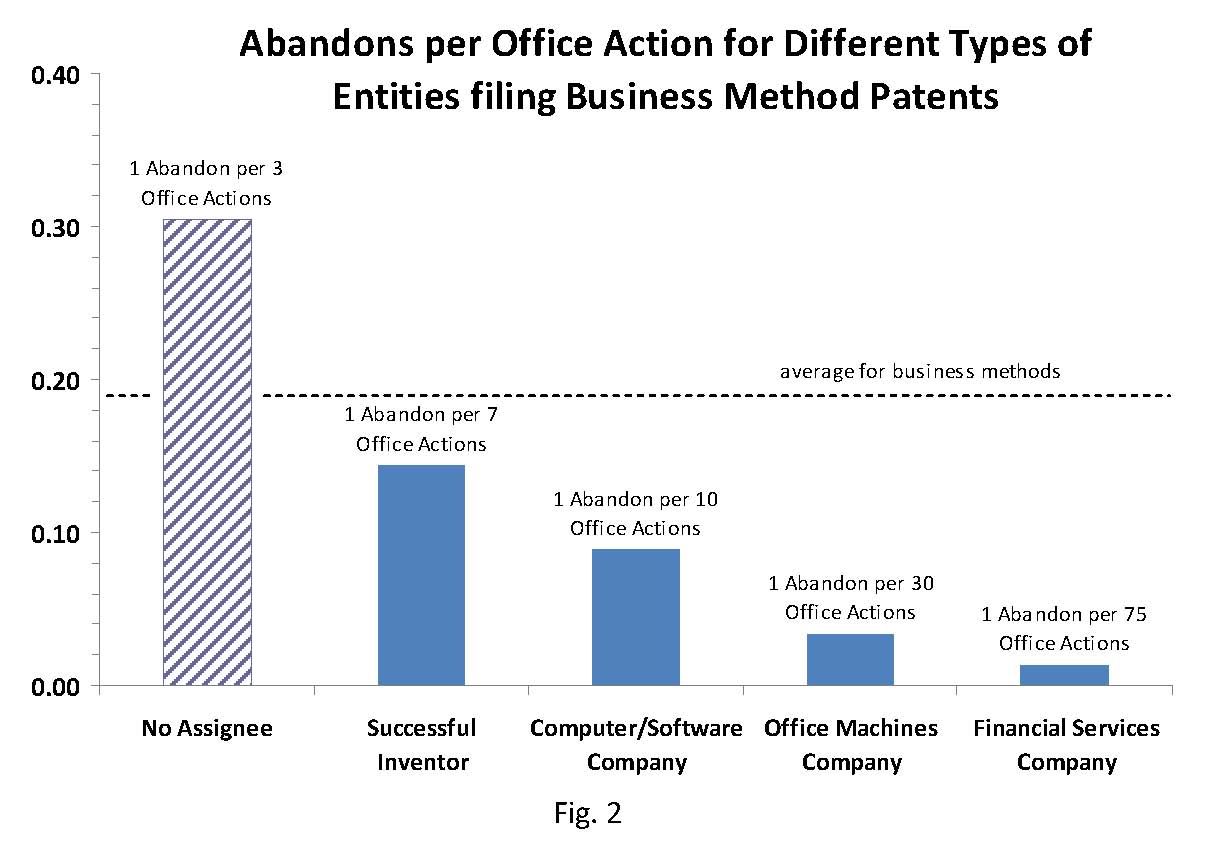

The level of speculation in a given portfolio of patent applications is a strong function of who is filing them. Figure 2 compares the abandons per action for different entities in the field of business methods (class 705). Data for three major companies is shown along with that of a successful individual inventor and a large group of independent inventors collectively referred to as “no assignee”. The major companies include a computer/software company, an office machines company and a financial services company. Each of these companies has filed hundreds of business method applications. The successful inventor has also filed several hundred applications over the past decade. His portfolio is currently valued somewhere in the nine figures. Companies spun off from this portfolio have gone on to significantly impact our economy. “No assignee” accounts for 30% of the applications in business methods. The data bar is shown striped as opposed to solid to indicate that it is a collection of entities. We don’t know of any billion dollar inventions in this group (yet), but some of these applications have gone on to be enforceable patents with $80+ million litigation judgments assessed against infringers. The computer/software, office machines and financial services companies present a spectrum of increasing conservatism as reflected in their increasingly lower abandons per office action ratios. The computer/software company and office machines company each have formal programs for reviewing their pending applications and abandoning them when their value doesn’t prove out. This even occasionally includes abandoning an application after a notice of allowance. The Financial Services company, on the other hand, has an abandon rate that is so low that it suggests that no review at all is done of ongoing application value. Once the decision is made to file, it appears as if its outside counsel is authorized to prosecute to an allowance no matter how long it takes. Several of this company’s applications have had 10 or more rejections and still outside counsel continues to prosecute. Companies with abandon rates this low might do well to develop policies and procedures to thin out their applications and focus on the inventions that have proven significant value.

Abandons per office action is a powerful metric for assessing the speculative nature of a given portfolio of patent applications. High ratios correspond to highly speculative ideas. Low ratios correspond to more conservative ideas. Investors looking to find breakthrough ideas, might do well to examine portfolios with high abandons per action. Investors looking for more stable returns on innovation might do well to examine portfolios with low abandons per action. Entities with exceptionally low abandon rates should perhaps develop policies and procedures to more realistically assess the ongoing value of their innovations and thin out those that don’t fulfill their initial promise so that they can focus on those that do. |