| Insurance IP

Bulletin

An Information Bulletin on

Intellectual Property activities in the insurance

industry

A Publication of - Tom Bakos Consulting, Inc. and Markets, Patents and Alliances, LLC |

August, 2008 VOL: 2008.4 |

||

| Adobe pdf version | Give us FEEDBACK | ADD ME to e-mail Distribution |

| Printer Friendly version | Ask a QUESTION | REMOVE ME from e-mail Distribution |

| Publisher Contacts

Tom Bakos Consulting, Inc.

Tom Bakos: (970) 626-3049 tbakos@BakosEnterprises.com Markets, Patents and Alliances, LLC Mark Nowotarski: (203) 975-7678 MNowotarski@MarketsandPatents.com Patent Q & A Peer

to Patent Disclaimer:The answer below is a discussion of typical

practices and is not to be construed as legal advice of any kind. Readers

are encouraged to consult with qualified counsel to answer their personal

legal questions. Answer: Yes but there is a “Catch 22” Details: The Peer to Patent pilot project has just been extended for a year and qualifying patent applications now include business methods, such as those that may be filed with respect to insurance products. As we discussed in the October 2007 issue of the Insurance IP Bulletin, Peer to Patent is a public forum for reviewing pending patent applications. Members of the public can read applications that are posted and upload prior art along with commentary to help the patent examiner examine the application. The results in the first year of operation, which was open to patent applications in the computer-related arts, have been encouraging. Examiners are finding the comments by the public helpful and some of the prior art submitted has been better than what the Examiner, working alone, was able to find. An attractive feature for business method inventors is that if they volunteer their pending applications for Peer to Patent review, they will have their applications examined right away. This can be a major time savings considering that the current backlog in examination of business method patents is over seven years. See our February 2008 issue for details on the backlog. In addition, members of the public expected to participate in Peer to Patent would be individuals with expertise in the subject matter of the applications. Their expertise may lead to better examination and better examination leads to better patents. In order to sign up for Peer to Patent, however, your patent application must be published and the Applicant (e.g. inventor) must sign a consent form that allows the USPTO to accept outside commentary. A copy of the consent form can be found here. The “Catch 22” has to do with the date requirements for publication of your patent application. If you filed your application a while ago and it was published more than a month ago, then the patent office can’t accept it for the Peer to Patent program due to certain statutory time constraints on accepting prior art from the public after an application has been published. If your application was published a year ago, for example, it won’t be eligible for Peer to Patent. If you file your application right now, however, it still might not get into Peer to Patent since patent applications are normally published 18 months after they are filed, and the Peer to Patent pilot program ends in 10 months (July 2009). So if you filed a while ago you can’t get in and if you file right now you can’t get in. Only those applications filed in a narrow time window where they will get published in the next few months can get in without any extra effort. There are ways to get around this apparent Catch 22. If you file now, you can also file a “request for early publication”. This typically gets your patent application published in 2 to 3 months, plenty of time for Peer to Patent review. If your application was published more than a month ago, there are some other techniques available to still get your application reviewed on Peer to Patent, but that is best left as a discussion with your registered patent agent or attorney before taking any action. For those that do choose to participate in Peer to Patent, we look forward to seeing your applications posted on the site and may very well put in our 2 cents with uploaded prior art and commentary.

· Expand the degrees and areas of study that qualify an individual to become a patent attorney/agent (or patent examiner) so that these prerequisites include subjects like actuarial science, business (e.g. MBA), economics, and finance. · Allow the patent office to retain experts to aid examiners in areas of art in which the patent office has no ordinary or reasonable skill. · Utilize a method, such as Peer to Patent, in which pending patent applications are given public exposure in fields of art where the patent office examiners have limited training or experience. Through such a process, patent examiners would, at least, have informal exposure to expert thinking in the field of art of the patent application. The recently issued Lincoln patents (see below) on annuities with guaranteed minimum withdrawal benefits were referred to by way of example. These patents are currently undergoing litigation. Tens if not hundreds of millions of dollars are at stake. The conflicts between the parties might very well have been avoided if these patents had been drafted by patent attorneys with a more formal background in the financial arts and if the applications had had a more timely, thorough, and expert examination in the patent office. The USPTO response addressed the

suggestions made in the letter and indicated the USPTO is very aware of

the inefficiencies in examining patent applications in class 705 (business

methods). As noted in the response and in this issue’s Q&A, Peer

to Patent has been opened up to class 705 business method patents.

The participation of insurance and financial services subject matter

experts in Peer to Patent should help assure higher quality patents being

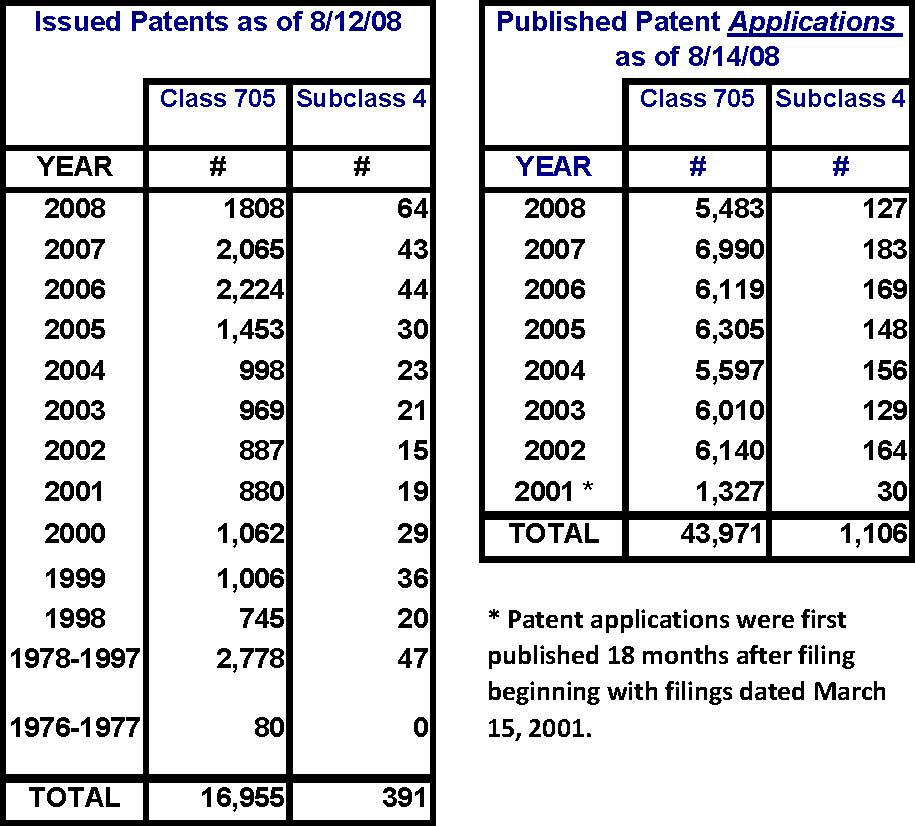

issued in class 705. Lincoln National Life Insurance Company now has three patents covering the methods and processes used in providing Guaranteed Minimum Withdrawal Benefits (GMWBs) for variable annuities. Two additional patent applications remain pending. Lincoln is asserting its patent rights through patent infringement lawsuits against two competitors who offer GMWBs: Transamerica Life Insurance Company and Jackson National Life Insurance Company. GMWBs have been credited with saving the variable annuity industry and are commonly offered by many of the 25+ insurers currently selling variable annuity products. Lincoln National’s claim of protected patent ownership of the GMWB benefit is a threat to competitors offering GMWBs in the variable annuity market. Tom Bakos (co-editor of the Insurance IP Bulletin) has prepared a comprehensive Intellectual Property Analysis of the Lincoln National GMWB family of IP. This analysis (over 200 pages of printed detail plus supporting documents on CD) represents well over 200 hours of review, analysis, and dissection of the specifications and claimed inventions. It describes prior art (believed to be relevant) either not disclosed or not considered by the USPTO on examination. It addresses the quality of the claims made. This analysis will be a valuable resource for anyone seeking a better understanding to the Lincoln claimed inventions. For more information regarding this Analysis and how to acquire it, please go to: Intellectual Property Analysis (http://www.BakosEnterprises.com/IPA). Statistics An Update on Current Patent Activity The table

below provides the latest statistics in overall class 705 and subclass 4.

The data shows issued patents and published patent applications for this

class and subclass.

Class 705 is defined as: DATA PROCESSING: FINANCIAL, BUSINESS PRACTICE, MANAGEMENT, OR COST/PRICE DETERMINATION. Subclass 4 is used to identify claims in class 705 which are related to: Insurance (e.g., computer implemented system or method for writing insurance policy, processing insurance claim, etc.). Issued

Patents 14 new patents have been issued during the last two months for a total of 64 in class 705/4 during the first 8 ½ months of 2008. Patents are categorized based on their claims. Some of these newly issued patents, therefore, may have only a slight link to insurance based on only one or a small number of the claims therein. The Resources section provides a link to a detailed list of these newly issued patents.Published Patent

Applications 35 new patent applications have been published during the last two months for a total of 127 during the first 8 ½ months of 2008 in class 705/4 continuing the pace of the prior two months and indicating a stable level of patent activity in the insurance industry in 2008 (about 15 applications per month). The Resources section provides a link to a detailed list of these newly published patent applications. Again, a reminder - Patent applications have been published 18

months after their filing date only since March 15, 2001. Therefore, there are many pending

applications that are not yet published. A conservative estimate would be that

there are, currently, close to 250 new patent applications filed every

18 months in class 705/4. The published patent applications included in the table above are not reduced when applications are issued as patents, rejected, or abandoned. Therefore, the table only gives an indication of the number of patent applications currently pending. Resources Recently published issued U.S. Patents and U.S. Patent Applications with claims in class 705/4. The following are links to web sites which contain information helpful to understanding intellectual property. United States Patent and Trademark Office (USPTO) : Homepage - http://www.uspto.gov/ United States Patent and Trademark Office (USPTO) : Patent Application Information Retrieval - http://portal.uspto.gov/external/portal/pair Free Patents Online - http://www.freepatentsonline.com/

Patent Law and Regulation - http://www.uspto.gov/web/patents/legis.htm Here is how to call the USPTO Inventors Assistance Center:

Mark Nowotarski - Patent Agent services – http://www.marketsandpatents.com/ Tom Bakos, FSA, MAAA - Actuarial services – http://www.BakosEnterprises.com |

Introduction

In this issue’s feature article, Sparky, co-editors Tom Bakos and Mark Nowotarski address inventorship and its importance to patents. In our Patent Q/A, we discuss how the USPTO has recently opened up Peer to Patent to business method patents in class 705. Insurance inventors can now get their patent applications examined in a matter of months rather than years provided they are willing to let members of the public review and comment on said applications. We make available a letter sent by Tom Bakos to the

USPTO Director, Jon Dudas, regarding patent examination efficiency in

class 705 with recommendations to improve it. We also link to the

response from the Director’s office outlining the Office’s own plans to

improve efficiency in

this area. Our

mission is to provide our readers with useful information on how

intellectual property in the insurance industry can be and is being

protected – primarily through the use of patents. We will

provide a forum in which insurance IP leaders can share the challenges

they have faced and the solutions they have developed for incorporating

patents into their corporate culture. Please

use the FEEDBACK link to provide us with your comments or

suggestions. Use QUESTIONS

for any inquiries. To be

added to the Insurance IP Bulletin e-mail distribution list, click on ADD

ME. To

be removed from our distribution list, click on REMOVE ME. Thanks, Tom

Bakos & Mark Nowotarski FEATURE ARTICLE Sparky By: Tom Bakos, FSA, MAAA & Mark

Nowotarski, Patent Agent In the insurance and financial services industries “inventing” has never been the focal point or job assignment that it has been in the more high tech industries, such as aerospace, pharmaceuticals and electronics. If your job is high tech you may be specifically hired to make inventions. You might invent new machines (e.g. cell phones), produce new products (e.g. pharmaceuticals), or develop better, stronger, or more economical raw materials (e.g. plastics). In that kind of job, it is expected that you will be inventive and patents may flow from your work like sparklers in the night sky. A patent-a-year is not uncommon. A patent-a-week is not unheard of. Inventors that prolific might well deserve the nickname “Sparky”. On the other hand, professionals in the insurance and broader financial services areas are not as likely to acquire a nickname like Sparky. The “products” they make can’t be held in your hand or shipped by a truck. Their invention is hard to see. Furthermore, it is unlikely that people who work for insurance companies, banks, or financial services companies were hired to be or expected to be inventors. The industry mind set is different. “Creative financing” is not always seen as a virtue. That is not to say, however, that those people are not inventive. All creative problem solvers are potential inventors. So, while technology professionals may clearly recognize their inventorship abilities, those in the finance industries may need a little prodding. Invention is a discovery process. It may result from seeing what everyone else sees but in a different way. It is a creative process applied with an open mind. It can produce results in an instant or take years of determined investigation. It may involve not just an overall approach to solving a problem but a full, detailed workable solution. Human progress, beginning in pre-history, has only been possible through invention. The wheel, for example, dates from Mesopotamia around 3,500 BC. The protection of individual invention through the use of patents, however, is a relatively recent phenomenon so the inventor of the wheel not only gets no credit today but, probably, got none then either. Of course an inventor has no obligation to seek patent protection. Patent or not, he or she will still be the inventor. And, it should also be recognized that invention can be a group activity. Inventorship in the US is determined by the “claims” of a patent. Claims are one sentence lists of the features of the actual invention. The technical patent term for these features is “limitation”. A claim, therefore, lists the limitations or boundaries of what the inventor(s) have exclusionary rights to. All persons who came up with the original idea for at least one limitation or combination of limitations must be listed as an inventor. It’s not an option. It’s also not something that can be bestowed upon someone as recognition for their support. The sponsor of a research project or the manager of a group cannot be listed as an inventor unless he or she had the original idea for at least one of the limitations in the claims. Inventorship is a legal determination made by a patent agent or attorney based on the evidence (e.g. signed dated notebook records, emails, personal testimony, notes on the back of napkins, etc.) provided by the persons involved in coming up with the invention. Once the agent or attorney has the evidence, then he or she can compare it to the limitations of the claims and determine inventorship. It’s generally a good idea to err on the side of listing more inventors rather than less. As we will discuss below, the downside risks of failing to list an inventor in a timely manner can be substantial. In the financial services industry, it is common for people to feel a bit uncomfortable about being credited with invention. “Oh”, they say, “Anyone could have come up with that”. Perhaps, but if the solution is not obvious to a person of ordinary skill then it is inventive. The issue is not that someone else could have solved the problem but who actually did. Serendipity counts. Things can get dicey if an inventor is left off of a patent. That person can go off and file his or her own “interfering” patent application on the same invention. Sorting the mess out can cost a great deal of time and money, particularly if said person is a disgruntled ex-employee. Sometimes inventors refuse to be listed on a patent. This can happen when a consultant is hired to solve a problem, comes up with a creative solution and wants to be free to use that solution with other clients. It is best to sort out issues of ownership of inventions before a consultant is engaged. Similar to ex-employees, negotiating a solution after the fact can cost a great deal of time and money. Inventorship is critical in the US because every inventor listed on a patent will own their own copy of the patent once the patent issues. Each inventor will be able to license the patent to whomever they wish without regard to the desires of any of the other inventors, no matter how small their inventive contribution was. To forestall multiple ownership of the same patent, it is common for all inventors to decide before a patent application is filed, who, or what corporate entity will own the patent when it issues. Each and every inventor then signs an “assignment” document transferring their ownership rights to the person or corporation. That way, only one entity controls the patent. If the inventors are the employees of a corporation, the “decision” to assign might be in the form of an employee agreement each of them signed when they were first hired. In the employee agreement, the employee agrees to assign ownership to any invention he or she makes during the course of employment to his or her employer. This may be unfamiliar in the financial services industry where “invention” is not normally seen as an everyday job function, but it is nearly universal in the more traditional, patent intensive, technology based industries. Sometimes inventorship can change as a patent application is “prosecuted”. Prosecution is the negotiation between the inventors and the patent office as to what limitations should be in the claims. It is very common for the limitations to be changed as new prior art is uncovered by a patent examiner. When the amended claims are finally allowed, it is prudent to revisit the issue of inventorship to make sure that no one has been left off or that everyone that is listed should be listed. If a change needs to be made, it’s a simple process as long as there has been no “deceptive intent” on the part of the inventors. So, even if you never thought of yourself as an inventor, if you solve a problem creatively you may be one. If that creative solution finds its way into a patent, then you should be listed as an inventor. |