| Insurance IP

Bulletin

An Information Bulletin on

Intellectual Property activities in the insurance

industry

A Publication of - Tom Bakos Consulting, Inc. and Markets, Patents and Alliances, LLC |

June 15,

2006 VOL: 2006.3 |

||

| Adobe pdf version | FEEDBACK | ADD ME to e-mail Distribution |

| Printer Friendly version | QUESTION | REMOVE ME from e-mail Distribution |

| Publisher Contacts

Tom Bakos Consulting, Inc.

Tom Bakos: (970) 626-3049 tbakos@BakosEnterprises.com Markets, Patents and Alliances, LLC Mark Nowotarski: (203) 975-7678 MNowotarski@MarketsandPatents.com Patent Q

& A Title: Accelerated Examination Question: Is there anyway I can speed up the process for getting a patent?Disclaimer:The answer below is a discussion of typical

practices and is not to be construed as legal advice of any kind. Readers are

encouraged to consult with qualified counsel to answer their personal legal

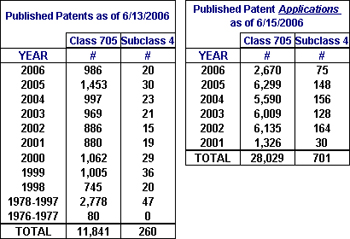

questions. Answer: Yes, It’s called a Petition to Make Special (PTMS) Details: "You know", said John Love, "I don’t know why more inventors don’t use the Petition to Make Special. It would really speed up the examination of their applications." John was the director of art unit 3600 at the USPTO at the time. Art unit 3600 includes business methods. I was chatting with him as we were walking down the hall of the patent office about the problem of unusually long delays in getting business method patents examined. With the step increase in business method filings after the State Street Bank decision in 1998, the heightened scrutiny that the patent office was giving to business method patents and the ongoing challenges of hiring and training qualified patent examiners in this area, delays in getting an examiner to look at an application (i.e. issue a first office action) had stretched out to over four years. John reminded me, however, of an option that all patent agents and attorneys should know about, the Petition to Make Special. In essence, anyone can have their application examined early if they submit a petition that meets certain criteria. Basic Ed.Insurance is a Process of Processes - Contingent Events Our mission has been to provide useful information on how innovation in the insurance industry can be protected with patents, principally, but also with trademarks and copyright. The presumption has been that our readers were already fairly familiar with the business of insurance. So, we have focused on providing education and insight into IP protection processes. In order to understand innovation and invention in the insurance business, it is very helpful to understand insurance. We find that the presumption that our readers are well versed in insurance principles and only need help understanding the IP protection side is not 100% correct. Many have a greater understanding of the patent processes than they do of the insuring processes which can present just as great a difficulty in identifying invention as the other way around. So, we will try to address this void by providing in this Basic Ed. column some basics on insurance. We hope that it will be informative to all of our readers. StatisticsAn Update on Current Patent Activity The table below provides the latest statistics in overall class 705

and subclass 4. The data shows issued patents and published patent

applications for this class and subclass.

Class 705 is defined as: DATA PROCESSING: FINANCIAL, BUSINESS PRACTICE, MANAGEMENT, OR COST/PRICE DETERMINATION. Subclass 4 is used to identify claims in class 705 which are related to: Insurance (e.g., computer implemented system or method for writing insurance policy, processing insurance claim, etc.). Issued

Patents Since our last issue, 9 new

patents with claims in class 705/4 have been issued: 4 relate primarily to

L&H, 2 relate to P&C insurance in general; and 3 appear to have

applications in all lines. Five of these nine newly issued patents have an

assignee indicated. The other four are to independent inventors.

Patents are categorized

based on their claims. Some of these newly issued patents, therefore, may

have only a slight link to insurance based on only one or a small number

of the claims therein. The

Resources section provides a link to a

detailed list of these newly issued patents.

Published Patent Applications Thirty eight (38) new patent

applications with claims in class 705/4 have been published since our last

issue. They are broken down by product line or type area as follows:

P&C:

16 The Resources section provides a link to a detailed list of these newly

published patent applications. Again, a reminder - Patent applications have been published 18

months after their filing date only since March 15, 2001. Therefore, there are many pending

applications that are not yet published. A conservative assumption would be

that there are, currently, about 200 new patent applications filed every

18 months in class 705/4. The published patent applications included

in the table above are not reduced when applications are issued as

patents, rejected, or abandoned.

Therefore, the table only gives an indication of the number of

patent applications currently pending.

Resources

Recently published issued

U.S. Patents and U.S. Patent Applications with claims in class

705/4. The following are links to web sites

which contain information helpful to understanding intellectual

property.

United States Patent and

Trademark Office (USPTO) : Patent

Application Information Retrieval -

http://portal.uspto.gov/external/portal/pair Free Patents

Online -

http://www.freepatentsonline.com/ World Intellectual Property

Organization (WIPO) - http://www.wipo.org/pct/en Patent Law and

Regulation -

http://www.uspto.gov/web/patents/legis.htm

Here is how to call the USPTO Inventors Assistance Center:

Mark Nowotarski - Patent Agent services – http://www.marketsandpatents.com/ Tom Bakos, FSA, MAAA -

Actuarial services – http://www.BakosEnterprises.com |

In this issue’s feature article, What’s In a Name: Choosing an Effective Trademark , our guest author, Leora Herrmann, Esq., takes a look at trademarks, the other activity of the United States Patent and Trademark Office (USPTO). She notes that, Shakespeare notwithstanding, there is something in a name.In our Patent Q/A section we talk about how to use a Petition to Make Special to accelerate the examination of your patent application so that you can get a business method patent to issue in as little as 2 years instead of the normal 5 or more years. We also discuss the basics of how insurance works in a new Basic Ed. feature: Insurance is a Process of Processes. We do this in order to bring to our readers who may not be too deeply involved in the business of insurance some basic understanding of just what is going on that may be inspiring the innovative spirit. We expect to follow this up in future issues with more explanation and would welcome reader comments on subject areas we ought to consider first. The Statistics section updates the current status of issued US patents and published patent applications in the insurance class (i.e. 705/004). We also provide a link to the Insurance IP Supplement with more detailed information on recently published patent applications and issued patents.

Our mission is to provide our readers with useful information on how intellectual property in the insurance industry can be and is being protected – primarily through the use of patents. We will provide a forum in which insurance IP leaders can share the challenges they have faced and the solutions they have developed for incorporating patents into their corporate culture. Please use the FEEDBACK link above to provide us with your comments or suggestions. Use QUESTIONS for any inquiries. To be added to the Insurance IP Bulletin e-mail distribution list, click on ADD ME. To be removed from our distribution list, click on REMOVE ME.

Thanks, FEATURE ARTICLE What’s In a Name: Choosing An Effective Trademark By: Leora Herrmann, Esq., Partner, Kluger, Peretz, Kaplan & Berlin, lherrmann@kpkb.com http://www.kpkb.com/professionals-28.html"What’s in a name? That which we call a rose by any other name would smell as sweet." So spoke the heroine in Shakespeare’s Romeo and Juliet. Juliet’s sentiment rang true in the Bard’s tale of star-crossed lovers. But, when it comes to business, she couldn’t have been farther from the mark. In insurance, as in any other industry, names are the key to effective marketing. They differentiate one company or product from all others, enable customer loyalty and foster goodwill. The names (and logos) companies use for their goods and services are protected by the law of trademarks, a branch of intellectual property law. Trademark law gives the owner of a valid trademark a monopoly that allows it to stop others from adopting any confusingly similar mark for related goods or services. A trademark monopoly is best established by registering one’s trademark with the United States Patent and Trademark Office (USPTO). A federal trademark application can be filed as soon as a company has a bona fide intent to use the mark. This gives the applicant nationwide priority over others who later adopt the same or a similar mark for related goods or services. But not all names qualify for trademark protection. The key is to choose a protectible name that does not infringe on others’ established trademark rights. As Shakespeare would say, "There’s the rub." First, in choosing a trademark, avoid generic terms. The generic names for goods or services belong to the public at large and cannot be monopolized by a single company. Just as no one can claim "automobile" as a trademark for cars, any word that is the generic name for an insurance product is off limits as a trademark. Descriptive terms are a step in the right direction, but still difficult to protect. In 2005, Allianz Life Insurance Company of North America’s application to register WEALTHCARE as a trademark for healthcare insurance, life insurance and annuities was rejected by the USPTO because "the term WEALTHCARE is merely descriptive of a function or purpose of Applicant’s insurance services, that is, to care for or manage the insured’s wealth." Descriptive terms like WEALTHCARE are not given trademark status unless and until they have been so widely advertised and used that they have acquired "secondary meaning" with the public; that is, the public has learned to recognize them as trademarks despite their descriptiveness. In the case of WEALTHCARE, the USPTO found that Allianz had not shown that "relevant customers of such insurance services have come to view WEALTHCARE as Applicant’s source-identifying mark," rather than a mere description of the insurance that Allianz offered. As a result, trademark protection was denied. To avoid this fate, stay away from descriptive marks. A better choice for a trademark is a term or phrase that is

"suggestive." Suggestive marks evoke an image related to the product or

service, but do not describe it. They are protectible without proof of

secondary meaning. In a recent federal lawsuit, the court held that

CAREFIRST is a suggestive trademark for health insurance and related

services because "CareFirst connotes some kind of health-related service

or product, although consumers would be unlikely to identify the service

or product without actual knowledge of it." Fanciful and arbitrary terms make the best marks. KODAK – a coined term – is a fanciful mark and APPLE for computers is arbitrary. Marks like these, which do not describe or even suggest the goods and services for which they are used, are the strongest and most easily protectible. They may, however, be less desirable for marketing purposes. A suggestive mark like CAREFIRST connotes reliability, compassion and responsiveness. It’s more difficult for an arbitrary or fanciful mark to evoke such sentiments. The selection of a protectible term is the first step in choosing a trademark. The second is to determine, with as much confidence as possible, that the mark will not infringe existing third party trademark rights; that is, that the mark is available. This evaluation should be performed by a qualified trademark attorney who will first conduct and commission a trademark search to identify third parties who have registered or are using identical or similar marks. If the mark will be used internationally, foreign trademark searches must also be commissioned and evaluated. Just because a search reveals that the term is already being used as a trademark does not mean that it is off limits. Trademark availability depends on whether simultaneous use of both marks will create a likelihood of confusion among purchasers. This is determined by weighing such factors as the strength of the prior trademark, the similarity of the marks, the similarity of the parties’ goods and services, the sophistication of the relevant group of consumers, and the extent to which advertising and distribution channels overlap. Clearly, under the right circumstances, the same word can be used as a mark in different fields without confusing the public. No one mistakenly concludes that Delta Airlines is the source of Delta faucets, or that the Ford Modeling Agency is the source of Ford automobiles. However, where the parties’ goods and services are more closely related, a likelihood of confusion may arise. Thus, some years ago, Guardian Life Insurance Company succeeded in getting an injunction against an independent insurance agency barring it from using the name Guardian Group-Gerardi Associates as its service mark. (A service mark is nothing more than a trademark that is used to identify the source of services.) Even though the agency’s sales of life, group and business health insurance amounted to only 5.75% of its business, the court concluded that consumers were likely to conclude that the agency was affiliated with Guardian Life and ordered it to stop using "Guardian" in its name. Choosing a trademark can involve multiple false starts. The obvious "good names" are often already taken. But with creativity, persistence and good legal advice, a trademark that is effective, available and protectible can always be found. NOTE: More information about trademarks is available at the USPTO Trademark web site: http://www.uspto.gov/main/trademarks.htm |