| Insurance IP

Bulletin

An Information Bulletin on

Intellectual Property activities in the insurance

industry

A Publication of - Tom Bakos Consulting, Inc. and Markets, Patents and Alliances, LLC |

April 15,

2006 VOL: 2006.2 |

||

| Adobe pdf version | FEEDBACK | ADD ME to e-mail Distribution |

| Printer Friendly version | QUESTION | REMOVE ME from e-mail Distribution |

| Publisher Contacts

Tom Bakos Consulting, Inc.

Tom Bakos: (970) 626-3049 tbakos@BakosEnterprises.com Markets, Patents and Alliances, LLC Mark Nowotarski: (203) 975-7678 MNowotarski@MarketsandPatents.com Patent Q

& A Reexamination – a USPTO Do

Over Question: What can you do if an obviously invalid patent issues? Disclaimer:The answer below is a discussion of typical

practices and is not to be construed as legal advice of any kind. Readers are

encouraged to consult with qualified counsel to answer their personal legal

questions. Answer: File a request for a reexamination1. Details: A reexamination is a way to correct patents after they have issued. A request for a reexamination can be filed by anyone at anytime during the period of enforceability of a patent when "a substantial new question of patentability" arises. The NTP patents covering BlackBerry™ technology, for example, are currently undergoing a number of reexaminations because new prior art has been discovered which hadn’t been considered by the patent office when the patent applications were first examined. If it turns out that the new prior art anticipates the NTP inventions or makes them obvious, then the claims covering those inventions will either be narrowed or cancelled. In order to request a reexamination, one needs to submit a "request for reexamination", pay a fee and provide an explanation of the new reasons why the patent is invalid. These reasons must be based on prior art. Copies of the prior art must be provided and the requester has to let the patent owner know that a request has been filed. The patent office will then review the request, and if it does raise a substantial new question of patentability, they will order a reexamination. Most requests for reexamination are filed by third parties. Most of these parties are already involved in a patent infringement lawsuit. By filing a reexamination request, they can hopefully invalidate the patent while at the same time keeping their legal fees low. If the judge in the lawsuit agrees, then the trial proceedings may be delayed pending the outcome of the reexamination. Many requests for reexamination are filed by inventors themselves. They might do this before they sue someone for infringing their patent to make sure that their claims are valid in light of any prior art they may have discovered since the patent issued. A small number of reexaminations are initiated by the patent office itself. These are called "director initiated" reexaminations. They might be filed when a patent of questionable validity attains a lot of publicity. The director, for example, ordered several of the reexaminations of the NTP patents. Once a reexamination is ordered, a special examiner is assigned to the case,

and the patent goes through another examination similar to the examination it

received the first time around. If any claims are rejected in light of the new

questions raised, then the patent owner can narrow or cancel said claims to get

around the rejection. The patent owner can also submit new claims, provided they

are not any broader than the claims in the original patent. If the patent owner

and the examiner cannot come to an agreement, then the patent owner can appeal

the examiner’s decision to the Board of Appeals and Interferences. If

necessary, the patent owner can further appeal to the Court of Appeals for the

Federal Circuit, and the even the Once the reexamination has been concluded, a "Certificate of Reexamination" is issued. The certificate makes any corrections to a patent that were decided in the reexamination. If all of the claims are rejected, for example, then the certificate will indicate that all claims are cancelled and the patent owner will be left with a patent that doesn’t cover anything. The NTP patents are having a rough

time in reexamination. All of the claims have been rejected based on the

new prior art citations. Whether or not NTP can narrow their claims to get

around the rejections, or succeed in an appeal of the rejections, remains

to be seen. In either case, better examined patents will

result. Innovation in Patent Sales First Live

Patent Auction Sales Are $8.5 million Ocean Tomo held the first ever Live Patent Auction on April 6, 2006 in San Francisco CA. 26 of the 78 patent lots were sold on the floor for $3,026,000 - a success rate of 33%. Nearly 400 people attended the sold out event. Bidding on 52 of the lots on Thursday did not meet the seller’s minimum reserve but were offered in anticipated post-auction private trading. A number of such lots reached terms off the bidding floor with additional value of $5,600,000, bringing event sales to more than $8.5 million. The next Ocean Tomo Auction is set for October 25 and 26,

2006 in About Ocean Tomo,

LLC: Ocean Tomo, LLC is a merchant banc

specializing in understanding and leveraging intellectual property assets. The

firm, which was established in 2003, provides advice in IP-related mergers

and acquisitions, valuation, expert services and IP analytics. Ocean Tomo works closely with IP owners, advisors and

investors. The firm has offices in Patent

Information Sources – Mostly Free Stephen M. Nippers’ Invent

Blog We have listed in our Resources section a few websites in which information about patents and patent applications can be found. However, if you wish to do even more exploring on your own you might check out the list of patent download sources provide at Mr. Nippers’ website: http://nip.blogs.com/patent/2004/09/guide_to_downlo.html Patent Events April

23 – 25, 2006 – This annual conference attended by leaders in the auto insurance industry is

already sold out. For additional information see:

http://www.riskinformation.com Patent Troll Session at IP Rights for Financial Services

Meeting April 25 – 26, 2006, The Institute for International Research (IIR) will present a session on Patent

Troll Strategies for Financial Services Companies'' at Upcoming Institute for

International Research Conference at the upcoming IP Rights for Financial Services

meeting to be held on April 25 – 26, 2006. The meeting will be held at the

For registration and information, go

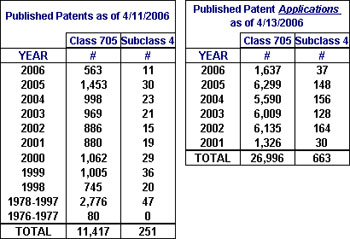

to http://www.iirusa.com/iprights. An Update on Current Patent Activity The table below provides the latest

statistics in overall class 705 and subclass 4. The data shows issued

patents and published patent applications for this class and

subclass.

Class 705 is defined as: DATA PROCESSING: FINANCIAL, BUSINESS PRACTICE, MANAGEMENT, OR COST/PRICE DETERMINATION. Subclass 4 is used to identify claims in class 705 which are related to: Insurance (e.g., computer implemented system or method for writing insurance policy, processing insurance claim, etc.). Issued

Patents Since our last issue, 6 new patents with claims in class 705/4 have been

issued: 2 relate primarily to L&H, 2 relate to P&C insurance in

general; and 2 can be applied in all lines. Five of these six newly issued

patents have an assignee indicated. Patents are categorized based on their claims. Some of these newly issued

patents, therefore, may have only a slight link to insurance based on only one

or a small number of the claims therein. The Resources

section provides a link to a detailed list of these newly issued patents. Published Patent Applications Twenty two (22) new patent applications with claims in class

705/4 have been published since our last issue. They are broken down by product

line or type area as follows: P&C:

8 Life

& Health 12 All: 2 Pension:

0 TOTAL: 22 The Resources section

provides a link to a detailed list of these newly published patent

applications. Again, a

reminder - Patent applications have been published 18

months after their filing date only since March 15, 2001. Therefore, there are many pending

applications that are not yet published. A conservative assumption would be

that there are, currently, about 200 new patent applications filed every

18 months in class 705/4. The published patent applications included

in the table above are not reduced when applications are issued as

patents, rejected, or abandoned.

Therefore, the table only gives an

indication of the number of patent applications currently pending. Resources

Recently published issued

U.S. Patents and U.S. Patent Applications with claims in class

705/4. The following are links to web sites

which contain information helpful to understanding intellectual

property.

United States Patent and

Trademark Office (USPTO) : Patent

Application Information Retrieval -

http://portal.uspto.gov/external/portal/pair Free Patents

Online -

http://www.freepatentsonline.com/ World Intellectual Property

Organization (WIPO) - http://www.wipo.org/pct/en Patent Law and

Regulation -

http://www.uspto.gov/web/patents/legis.htm

Here is how to call the USPTO Inventors Assistance Center:

Mark Nowotarski - Patent Agent services – http://www.marketsandpatents.com/ Tom Bakos, FSA, MAAA -

Actuarial services – http://www.BakosEnterprises.com |

In this issue’s feature article, A brief report on Ocean Tomo’s successful patent auction earlier this month is provided and their plans for a second auction expected to include patents in the financial services industry is noted. It’s not over until it’s over. Patent reexamination is explained as a relatively low cost way for the public to challenge the validity of a patent that has already issued. Surprisingly, inventors often ask for reexaminations of their own patents, just to be sure that their patents are valid before they enforce them. The Statistics section updates the current status of issued Our mission is to provide our readers with useful information on how intellectual property in the insurance industry can be and is being protected – primarily through the use of patents. We will provide a forum in which insurance IP leaders can share the challenges they have faced and the solutions they have developed for incorporating patents into their corporate culture. Please use the FEEDBACK link above to provide us with your comments or suggestions. Use QUESTIONS for any inquiries. To be added to the Insurance IP Bulletin e-mail distribution list, click on ADD ME. To be removed from our distribution list, click on REMOVE ME.

Thanks, FEATURE ARTICLE Ka-Ching! By: That’s "ka-ching", the sound you hear when you think you have just invented the next best thing since sliced bread. Individual inventors in the financial services industry have recognized early on that their innovations may be valuable and need protection. But, it is becoming more apparent that they are not the only ones who have caught on. We have noticed, not through any scientific study but through careful observation, that many more insurance patents are being sought by companies. This is made evident by the fact that a larger percentage of newly issued patents are being assigned to companies. For example, in March all four patents issued in class 705/4 had assignments recorded with the USPTO. Well, if you work for a company and do not already recognize the value a patent can add to a successful innovation – read on. Even if you remain a skeptic, you will, at least, understand what your competitors are doing. Patents Add Value It is accurate to say that a patent can add value to an invention. It may not, but it can. What a patent cannot do, generally, is create value. This, of course, implies that if the invention itself has no value, then patenting it could be considered pointless. The value a patent can add to an invention may be best expressed as a proportion to the inherent value of the invention itself. The value a patent adds to an invention lies in the right it gives the inventor (or assignee or owner) to exclude others from making, using, or selling the invention. The right to exclude implies a right to allow others to use the invention. Presumably the inventor would charge a fee or royalty for this right. The royalty income is additional profit the inventor might not be able to get because it could not otherwise address the entire market demand for the invention. Ka-ching! In some cases, the invention might be in a market the inventor does not want to be in or is not able to address. Perhaps the invention was designed to solve a problem in the inventor’s or assignee’s primary market but also has significant additional and non-competing applications in other markets. Therefore, the invention would not be used and would not realize its value potential in these other markets unless it was licensed out to others. Ka-ching! The inventor or assignee may enforce the right to exclude in order to retain 100% access to the market created by the patented invention. This may be because the market is small or because the inventor is big and capable of addressing 100% of the market demand for the product or products enabled by the patented invention. In this case, a patent allows the inventor (through excluding competitors) to achieve higher profits by not sharing the marketing opportunities with competitors. Ka-ching! The bottom line is that a valuable invention that the inventor does not protect with a patent may lose its value to the inventor as others utilize it for their own benefit. Implicit Value of a Patent The value of a patent may also be derived just from the fact that a patent implies an innovative spirit which may convey value in a marketplace, that is, a value associated with being a market leader who is aware of and addressing market needs. The ability to say one has a number of patents may convey a positive image in advertising and make the advertising more effective. Put it in the Bank Presumably, invention that results in a patent comes after research & development, or problem solving efforts that cost money. The resulting innovative product may not be able to be sold at a premium or charge high enough to recover the R&D costs (and be as profitable as desired) unless one were able to control competition. Historically, the insurance business has tended to be "follow the leader". That is, someone innovates and all the rest follow - copying the successes (and piggybacking on their R&D). A patent cuts this off by giving the innovator the right to exclude. This has value because it allows the inventor to recover R&D costs either through higher prices or through license fees charged to the followers. Also, while corporate sponsors of innovation can use patents to protect their R&D dollars, individual inventors will be better able to attract investor dollars in any company or enterprise they start aimed at capitalizing on the invention. Investor dollars are more likely to be attracted to an enterprise in which the intellectual property is protected from competitors or copycats. If you are a follower, contributing nothing to problem solving innovations, then you can justify your royalty payments or the infringement judgments against you as your R&D cost. For Use in Trade In a competitive environment in which your competitors have patents, your own patents can also be valuable for use in trade. The innovation even in issued patents, as we all should know from recent stories on patent infringement lawsuits and settlements (e.g. NTP vs. RIM’s recent $612 million settlement), is often difficult to pin down. Frequently patents may not stand up to the court scrutiny they are given in any infringement action and you really can’t depend on the patent office not changing its mind in reexamination (see Q&A in this issue) of patents it previously issued. Plus, patent infringement lawsuits cost a lot of money and take a really long time and a lot of effort which, unless you are a lawyer or a patent troll, is not really the business you want to be in. It is best to avoid infringement or even the question of infringement and that can be done more easily if you have a patent portfolio of your own. Other patent savvy companies in your industry will respect that. Patents grant a right to exclude – not an obligation to exclude others. So, you can use your patent portfolio in trade against potential claims of infringement by others either explicitly or implicitly. If they don’t sue you, you won’t sue them. It may not even be too important to determine if either has anything to sue about. Operating in your competitive market without a patent portfolio may be like taking your battle cruiser into Klingon space with your shields down. Big Picture In summary, a single invention either has value or it doesn't. Not every innovative approach will achieve commercial success. However, one's R&D efforts ought to be evaluated in their totality. A patent adds value to invention by giving the inventor exclusive access to profits to be derived from the invention. Patents in a corporation allow the corporation the opportunity to recover its R&D costs from failed as well as successful invention. There are many intelligent people who value intellectual property enough to

invest in protecting it and, at least, from their point of view were successful

in protecting it. NTP vs. RIM, already mentioned, showed a $612 million dollar

value. We have earlier also discussed the Bancorp vs. Some may remain skeptics on the value of patents in the insurance industry. But, be aware of the fact that the USPTO issued patent number 7,000,000 in February. And, be warned that the value of patents, well recognized in other industries, is spreading to the insurance and the broader financial services industries. Ka-ching! |