|

Insurance IP

Bulletin

An Information

Bulletin on Intellectual Property activities

in the insurance industry

A Publication of - Tom Bakos Consulting, Inc. and Markets, Patents and Alliances, LLC |

February 2011

VOL: 2011.1 |

||

| Adobe pdf version | Give us FEEDBACK | ADD ME to e-mail Distribution |

| Ask a QUESTION | REMOVE ME from e-mail Distribution |

|

Publisher

Contacts

Tom Bakos Consulting,

Inc.

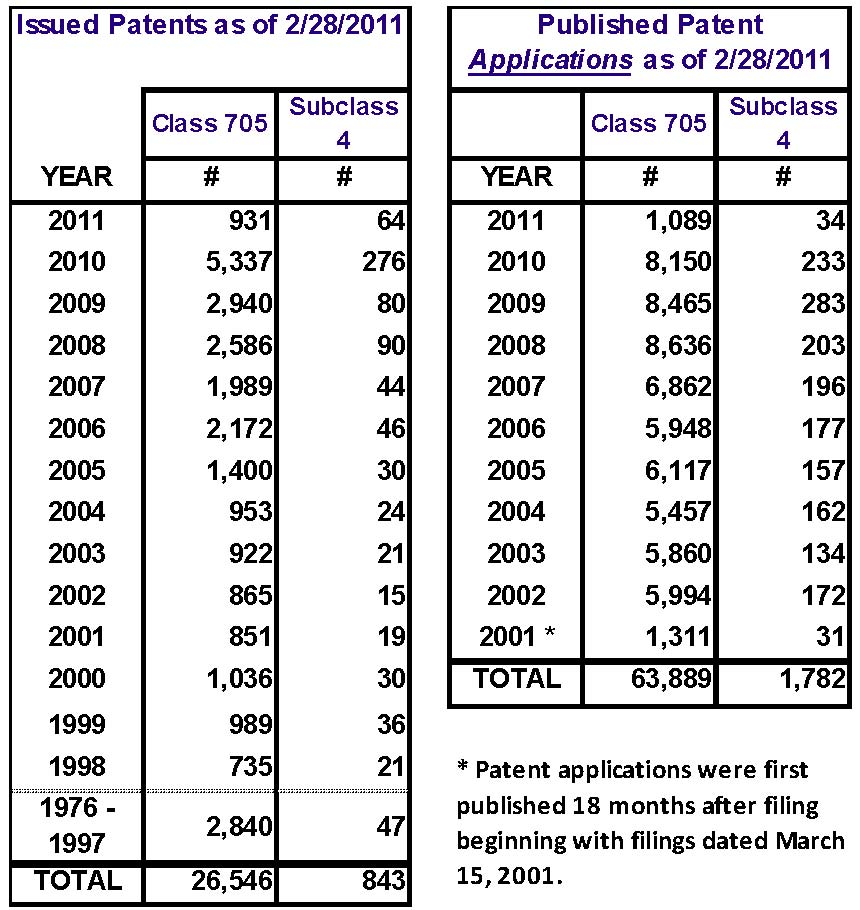

Tom Bakos: (970) 626-3049 tbakos@BakosEnterprises.com Markets, Patents and Alliances, LLC Mark Nowotarski: (203) 975-7678 MNowotarski@MarketsandPatents.com There is no Patent Q&A this issue. Please see our duscussion following the Feature Article on the Patent Reform Act of 2011. Statistics An Update on Current Patent Activity The table below provides the

latest statistics in overall class 705 and

subclass 4. The data shows issued patents and

published patent applications for this class

and subclass.

Class 705 is defined as: DATA PROCESSING: FINANCIAL, BUSINESS PRACTICE, MANAGEMENT, OR COST/PRICE DETERMINATION. Subclass 4 is used to identify

claims in class 705 which are related to:

Insurance (e.g., computer implemented system

or method for writing insurance policy,

processing insurance claim, etc.). Issued

Patents Patents are categorized based on their claims. Some of these newly issued patents, therefore, may have only a slight link to insurance based on only one or a small number of the claims therein. The Resources section

provides a link to a detailed list of these

newly issued patents. Published Patent

Applications The Resources section provides a link to a detailed list of these newly published patent applications.

United States Patent and Trademark Office (USPTO) : Homepage - http://www.uspto.gov/ United States Patent and Trademark Office (USPTO): Patent Application Information Retrieval - http://portal.uspto.gov/external/portal/pair Free Patents Online-http://www.freepatentsonline.com/ US Patent Search - http://www.us-patent-search.com/ World Intellectual Property Organization (WIPO) - http://www.wipo.org/pct/en Patent Law and Regulation - http://www.uspto.gov/web/patents/legis.htm Here is how to call the USPTO Inventors Assistance Center:

The following links will take you to the authors' websites. Mark Nowotarski - Patent Agent services - http://www.marketsandpatents.com/ Tom Bakos, FSA, MAAA - Actuarial services- http://www.BakosEnterprises.com |

Introduction

In this issue’s feature article, The Patent Reform Act of 2005 … 2007 … 2009 … 2011 … , we bring to your attention the latest version of patent reform legislation just introduced in February to the 112th Congress In place of our typical Patent Q/A we engage in a little speculation on what the impact of the proposed ban on "tax strategy patents" might be on insurance patents. The Statistics section updates the current status of issued US patents and published patent applications in the insurance class (i.e. 705/004). We also provide a link to the Insurance IP Supplement with more detailed information on recently published patent applications and issued patents. Our mission is to provide our

readers with useful information on how

intellectual property in the insurance industry

can be and is being protected - primarily

through the use of patents. We will

provide a forum in which insurance IP leaders

can share the challenges they have faced and

the solutions they have developed for

incorporating patents into their corporate

culture. Please use the FEEDBACK link to provide us with your comments or suggestions. Use QUESTIONS for any inquiries. To be added to the Insurance IP Bulletin e-mail distribution list, click on ADD ME. To be removed from our distribution list, click on REMOVE ME. Thanks,Tom Bakos & Mark

Nowotarski FEATURE ARTICLE The Patent Reform Act of 2005 … 2007 … 2009 … 2011 … By: Tom Bakos, FSA, MAAA & Mark Nowotarski- Markets, Patents & Alliances LLC - co-editors, Insurance IP Bulletin Well, here we go again. The Patent Reform Act of 2011 was introduced in the Senate on January 25, 2011, sent to the Judiciary Committee and unanimously reported out on February 3. It is expected the House will act – but more slowly given other issues on the table. The 2011 Reform Act is much like similar bills introduced in the 110th and 111th Congress. This one is, perhaps, more likely to pass since it is bipartisan and there is a good part of the legislative session left at this point. The 2011 Reform Act (as introduced in the Senate ) in 106 small, double spaced pages proposes amending Title 35, United States Code, to do the following: · Introduces a first-inventor-to-file approach. · Adds processes intended to improve patent quality. · Makes it more efficient to administratively challenge the validity of an issued patent. · Addresses damages. · Creates a Supplemental Examination process · Adds language intended to prohibit patents on tax strategies. It is the last item in the list above we will be devoting out attention to in this article – the attempt to add language to Title 35 USC that would not allow so-called tax strategies to be patented. This change is accomplished by the addition of two sentences (following) in Section 14 of the Senate Bill which is intended to deem tax strategies as falling within the prior art. (a) In General.—For purposes of evaluating an invention under section 102 or 103 of title 35, United States Code, any strategy for reducing, avoiding, or deferring tax liability, whether known or unknown at the time of the invention or application for patent, shall be deemed insufficient to differentiate a claimed invention from the prior art. (b) Definition.—For purposes of this section, the term ‘‘tax liability’’ refers to any liability for a tax under any Federal, State, or local law, or the law of any foreign jurisdiction, including any statute, rule, regulation, or ordinance that levies, imposes, or assesses such tax liability. Key IssuesWhat is a tax strategy?Section 14 is titled “Tax Strategies …” but what, exactly, is a tax strategy? Well, in paragraph (a) tax strategy is seemingly defined as: “any strategy for reducing, avoiding, or deferring tax liability”. This may encompass methods alternatively described as tax planning methods, tax shelters, or tax avoidance schemes all intended, as the quote above indicates, to reduce, defer, or avoid tax liability. So, an important part of the definition is that a tax strategy is a strategy for reducing, avoiding, or deferring taxes. That is, it would be reasonable to assume that a strategy which is designed for some other purpose but, as a consequence of implementing it, a coincidental result is the reduction, avoidance, or deferral of tax liability is not a tax strategy patent under this definition and, therefore, not affected by the proposed language. For example, patents on automobile engine technology or chemical patents on the formulation of gasoline which are designed to make automobiles more efficient burners of gasoline such that they achieve improved miles per gallon would not be considered tax strategy patents and, therefore, not patentable subject matter even though their application may result in the reduction or avoidance of gas tax liability. Remember, the proposed language addresses “any liability for tax under any Federal, State, or local law …” This view seems supported in a letter from the AICPA (American Institute of CPAs) to Lamar Smith in support of the tax strategy part of this legislation. In that letter they conclude that this legislation is not an outright ban but: Rather it simply precludes patent applicants from using a tax strategy as the point of novelty in their claims for an invention. Patent applicants can make any other argument about the novelty, non-obviousness, usefulness, or commercial applicability of their invention, but not to the exclusion of other taxpayers complying with the Federal tax code. Prior Art?The 2011 Patent Reform Act language bans tax strategy patents by deeming tax strategies to have been disclosed by prior art. Prior art, of course, is relevant public information available prior to the time of the claimed invention. The language of the bill indicates that tax strategies “shall be deemed insufficient to differentiate a claimed invention from the prior art.” This means that the prior art is deemed to make a claimed tax strategy invention either not new or obvious. The prior art being referred to must mean the tax law or regulation, itself. OK, that makes sense. But, if in fact a Federal, State, or local law etc. by virtue of the way it was written made a process to reduce, avoid, or defer taxes obvious, as one would expect it should, then why does that have to be deemed obvious by Section 14 of the 2011 Patent Reform Act? Why is it not simply obvious under current patent law? The issue may be that while tax law and regulation may be written to have a specific intended effect, there are often unintended consequences. These unintended consequences may be either: · technically legal (though not intended to be so) because of a poorly drafted law or regulation; or · probably not legal in that their application may require a particularly strained interpretation of the law. The first item above may be what is often referred to as a tax loophole. The second item above falls into a category that has been labeled abusive tax shelters. So, what does this contribute to the prior art issue? Well, if the tax law or regulation generated solely by itself an unintended consequence which did not exist prior to the law, then why isn’t it prior art under existing patent law? But, in any event, if the tax effect is truly unintended, than why not welcome a patent that would tend to restrict general or widespread use of a tax loophole? And, in the case of a probably illegal application of the tax code, an issued patent wouldn’t make it legal! So, who cares if a patent is issued? Known or UnknownAnother interesting part of the proposed language is defining a strategy for reducing, avoiding, or deferring tax liability, that is, a tax strategy, in terms of whether it is “known or unknown at the time of the invention or application for patent”. One way of interpreting this is that for something to be “known or unknown” it must exist. That is, enabling tax law or regulation must exist in order for a tax strategy patent to take advantage of it. So, in order for an inventor to devise a strategy for reducing, avoiding, or deferring tax liability, the inventor must know how the tax liability is applied or determined – otherwise, how would it be possible for the inventor and what would be the inventor’s motivation to devise such a strategy? It is possible that a strategy to accomplish some other result (i.e. not tax reduction, avoidance, or deferral) might be filed by an inventor who was totally oblivious to any applicable tax law or regulation. Such an invention might have a tax effect “unknown” to the inventor. However, since the invention was designed for some other purpose, one might argue it is not a tax strategy patent even though it has tax effects. Alternatively, the expression “known or unknown” might be interpreted to mean whether it exists or does not exist at the time of the invention. If that is the meaning then the intent of this provision might be to invalidate any patent previously issued which was a strategy but at the time of the invention not a tax strategy – because applicable tax law did not exist. For example, an inventor may have received a business method patent on a very efficient financial approach to saving for retirement. The Federal government decides that it should encourage people to participate in that retirement savings technique by changing the tax law to provide tax incentives to those who participate. Would the inventor have his patent invalidated so that others might offer his patented savings method? That is, might it be argued that his patent was made invalid by passage of the new tax law which made his invention a tax strategy patent? Or, could the inventor argue his invention is for other purposes than to reduce, avoid, or defer taxes. This may be

the most troublesome phrase of this two sentence

provision. We’ve contacted our Senators

for clarification on this issue, but have not

heard back at this

time. A Patent Expert (Mark) and an Insurance Expert (Tom) Converse Tom: OK, Mark, what say you? Isn’t prior art, prior art? What does this section add to a patent examiner’s quiver of tools to disallow claims that he or she doesn’t already have? Mark: I don’t think this adds anything to an examiner’s quiver. Examiners cannot be expected to be familiar with the tax code. Without that familiarity, they won’t be able to tell if an invention they are examining is a tax strategy or not. Tom: Is the language of Section 14 (i.e. the tax strategy section of the Reform Act) not only too short but too broad? It seems aimed at financial business method patents but might it not impact other types of invention? After all, doesn’t every commercial activity have a tax impact? Mark: Yes,

taken literally, this law could be used to

invalidate any patent in any field of

technology. But as of

May 3, Senator

Grassley read into the record

statements that make it clear that this law is

intended only to apply to inventions that would be

categorized by the patent office as 705/036T, tax

strategy patents. That makes this

law problematic for insurance inventors because

20% of those tax strategy patents are also

categorized as insurance patents, class

705/004. It used to be that no one really worried too much about what classes their pending application was put in. Now for insurance inventors, it will be critical that their applications are not assigned the 036T tax strategy class. I suppose that means careful drafting of applications and emphasis on the non tax related benefits of an insurance invention will be critical. Mark: Yes, and I think it would be worthwhile for patent attorneys and agents preparing these applications to become more familiar with how patents are classified. Perhaps a future article for the Bulletin? Tom: Absolutely. But let’s talk about the risk of an insurance invention becoming a tax strategy in the future due to changes in tax law or regulation. Do you really think that the bill is designed to make these patents invalid when it talks about tax strategies that are “unknown at the time of the invention”? Mark: Yes I do. I’ve spoken to a number of the people at the AICPA, the principal champions of this law, and my Senator’s office. The goal of this bill is to make sure that nothing that a tax accountant does would ever be considered patent infringement. The only way they can do that is to make sure that if anything patented does become a tax strategy in the future (i.e. a tax strategy that is unknown at the time of the invention) then that patent becomes invalid. Tom: But Mark, the AICPA note referred to above seems to be inconsistent with that. It includes this paragraph: No Existing Patents Will Be Nullified. The effective date of § 14 is prospective in nature. It will have no impact on the over 130 tax strategy patents which have already been issued by the Patent and Trademark Office, nor will it harm any other type of existing patents or copyright claims. I guess my

fear is that some overzealous interpreter of the

bill, if passed, will take us all down a road not

intended. I hope that we

are just being a little obsessive in our analysis

of the consequences of a bill like this on

ordinary inventive activity, or, if not, then

Congress will come to recognize that there are

potentially serious unintended

consequences. We are clearly

in a political environment in which tax policy is

used to motivate certain activity through tax

breaks or waivers. It would be

counterproductive if those tax breaks undermined

the very industries the tax breaks were designed

to support by weakening their patents

. [i] Based on an example by Greg Ahoranian . |