| Insurance IP

Bulletin

An Information Bulletin on

Intellectual Property activities in the insurance

industry

A Publication of - Tom Bakos Consulting, Inc. and Markets, Patents and Alliances, LLC |

February 15, 2007 VOL: 2007.1 |

||

| Adobe pdf version | Give us FEEDBACK | ADD ME to e-mail Distribution |

| Printer Friendly version | Ask a QUESTION | REMOVE ME from e-mail Distribution |

| Publisher Contacts

Tom Bakos Consulting, Inc.

Tom Bakos: (970) 626-3049 tbakos@BakosEnterprises.com Markets, Patents and Alliances, LLC Mark Nowotarski: (203) 975-7678 MNowotarski@MarketsandPatents.com

Buying a Patent Application Question: Is it possible to buy an inventor’s pending patent application before it issues as a patent?Disclaimer:The answer below is a discussion of typical

practices and is not to be construed as legal advice of any kind. Readers are

encouraged to consult with qualified counsel to answer their personal legal

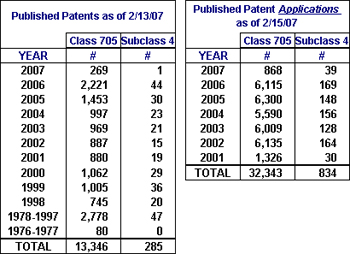

questions. Answer: Yes. Patent applications can be bought, sold and licensed just like issued patents. We’ve seen a significant increase in activity in the past few months of financial service companies approaching inventors to see if they could buy or license the inventors’ pending patent applications. These companies realize that a pending patent application could pose a problem for the new products they are developing if that patent application ever issues as a patent. They want to buy it now so that they can keep their future risks of patent infringement to a minimum. Unfortunately, many of these attempts to buy or license patent applications are failing. The main reason is that both financial service inventors and financial service companies are new to the patent game. One or both sides often become alienated by what the other side considers normal negotiating tactics. Many inventors, for example, become insulted when a company belittles their pending patent application. They don’t realize that the company is just trying to get the best price possible and is probably worried that the inventor will make outrageous price demands. If the company really thought that the patent application was worthless, they never would have contacted the inventor. Conversely, many companies are turned off by an inventor’s exaggerated claims of the importance of his or her invention. They don’t realize that the inventor is also trying to get the best price he or she can and is probably worried that the company will lose interest if the invention doesn’t, at least, revolutionize the industry. Despite these difficulties, however, some deals are going through. Those that have been successful report that it was essential to have an experienced patent negotiator involved. The patent negotiator helped both parties become familiar with the norms of patent licensing and how to properly interpret what the other side was really saying. The negotiations are still difficult, but the results have been worth it. Companies have reduced their future patent infringement risks, and inventors have received not only reasonable compensation, but a certain amount of recognition as well. Pending patent applications have value. More and more financial service companies are attempting to license or purchase patent applications relevant to their future business plans before they issue as patents. Those that are successful report that the services of a knowledgeable patent negotiator helped make the deal happen. Statistics An Update on Current Patent Activity The table below provides the latest statistics in overall class 705

and subclass 4. The data shows issued patents and published patent

applications for this class and subclass.

Class 705 is defined as: DATA PROCESSING: FINANCIAL, BUSINESS PRACTICE, MANAGEMENT, OR COST/PRICE DETERMINATION. Subclass 4 is used to identify claims in class 705 which are related to: Insurance (e.g., computer implemented system or method for writing insurance policy, processing insurance claim, etc.). Issued

Patents Things have slowed down a bit in 2007 with only one patent issued in class 705/4 during the first two months. Patents are categorized based on their claims. Some of these newly issued patents, therefore, may have only a slight link to insurance based on only one or a small number of the claims therein. The Resources section provides a link to a detailed list of these newly issued patents. Published Patent

Applications A total of 39 patent applications have been published indicating that there is still a substantial amount of patent activity in class 705/4. The Resources section provides a link to a detailed list of these newly published patent applications. Again, a reminder - Patent applications have been published 18

months after their filing date only since March 15, 2001. Therefore, there are many pending

applications that are not yet published. A conservative assumption would be

that there are, currently, about 200 new patent applications filed every

18 months in class 705/4. The published patent applications included in the table above are not reduced when applications are issued as patents, rejected, or abandoned. Therefore, the table only gives an indication of the number of patent applications currently pending. Resources Recently published issued U.S. Patents and U.S. Patent Applications with claims in class 705/4. The following are links to web sites which contain information helpful to understanding intellectual property. United States Patent and Trademark Office (USPTO) : Homepage - http://www.uspto.gov/ United States Patent and Trademark Office (USPTO) : Patent Application Information Retrieval - http://portal.uspto.gov/external/portal/pair Free Patents

Online -

http://www.freepatentsonline.com/ Patent Law and Regulation - http://www.uspto.gov/web/patents/legis.htm Here is how to call the USPTO Inventors Assistance Center:

Mark Nowotarski - Patent Agent services – http://www.marketsandpatents.com/ Tom Bakos, FSA, MAAA - Actuarial services – http://www.BakosEnterprises.com |

Lauren Bloom, former General Counsel for the American Academy of Actuaries, has written our Feature Article this month. She discusses the ownership of intellectual property created by professionals working in a business environment. While her focus is on actuaries doing work for an employer or a principal, it is equally applicable to any professional doing innovative technical work.

Our mission is to provide our readers with useful information on how intellectual property in the insurance industry can be and is being protected – primarily through the use of patents. We will provide a forum in which insurance IP leaders can share the challenges they have faced and the solutions they have developed for incorporating patents into their corporate culture. Please use the FEEDBACK link above to provide us with your comments or suggestions. Use QUESTIONS for any inquiries. To be added to the Insurance IP Bulletin e-mail distribution list, click on ADD ME. To be removed from our distribution list, click on REMOVE ME.

Thanks, FEATURE ARTICLE Whose

Work Is It, Anyway?

Intellectual

Property, Engagement Letters, and the Code of Professional Conduct for

Actuaries By: Lauren M. Bloom, Elegant Solutions Consulting - laurenmbloom@aol.com The actuarial profession came into being in the late 18th Century1, long before computers had even been imagined, much less invented. The first actuaries used paper, pencils, and relatively simple assumptions and methods to project how future events would likely unfold for the principals they served. Those actuarial pioneers did remarkably good work, given the tools available and the level of knowledge that existed at the time. Once the principal has agreed to the actuary’s ownership of various aspects of the work, it is normally important for the actuary to complete the work assignment consistent with the terms of the engagement letter in order to retain ownership of intellectual property. As work proceeds on a project, the actuary is usually wise to refrain from intertwining the principal’s data and other information with the actuary’s proprietary items to the point where the two become inseparable. This may require careful planning and execution on the actuary’s part, but can prevent disputes if the actuary is ever called upon to furnish data or other information to a successor actuary under Precept 10 of the Code or if the actuary wishes to market proprietary methods or models to someone other than the principal. 1

Encyclopedia of Actuarial Science (John Wiley

& Sons, 2004). |